The Western Investor Network Brokers recently attended the 2016 Colorado Real Estate Journal’s Industrial Summit & Expo. Take aways from the conference are:

Broker Update

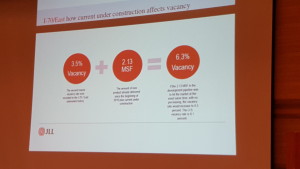

- Class “A” space for lease on the I-70 “east” corridor is hot! With just 2% vacancy, solid absorption, and lease rates averaging $5.15 PSF.

- High profile industrial parks that cater to Class “A” users are nice, very nice, but also expensive to operate and therefore expensive for end users to purchase or lease. Based on several recent high-profile land sales by companies planning to develop their own facilities, Walmart, Medline, McClane are a few, industrial parks seem to be losing their luster in the market as companies choose to go out on their own.

- Although unheard of just a few years ago, rumors are out there that Denver may be very close to securing our first 1,000,000 SF user, and the second is not far behind.

- Multi-family lending is cooling and will continue to become more difficult to secure.

- Cash out refi’s are going away and actually gone at certain lenders.

- There is a solid appetite for industrial product as lenders need to balance their portfolios due to the large amount of multi-family debt they are carrying.

Design & Construction

- The continued additional requirements placed on development by the municipal building departments (load and insulation requirements due to the cold & snow, etc.), planning and zoning restrictions in combination with delays in the approval process (9-12 months for approvals and 6 months to build) continue to drive up costs.

- Other popular amenities are: Exterior enhancements to boost curb appeal, day lighting (skylights), exhaust fans, evaporative cooled warehouse space, LED lighting and polished concrete floors.

- Buyers in the market are 2/3 private for the $2MM to $25MM range

- Institutional buyers are coming down in size to secure deals and better returns.

- East & west coast buyers are coming to Denver for CAP rate spread, a 5-6% CAP seems pretty good when 3.5%-4.5% is customary in their market.

- Sales are slow for the same reason we been hearing for several years, “Where will I place the money”.

- Buyers are starting to develop Class “A” buildings, leasing and holding them.

Properties with leases as short as 5 years are selling. There is an average 1.5 basis point increase in CAP rate between a 5 year term, a 7 year term, a 10 year term, etc., although National buyers require leases in excess of 10 years.

Development and Investment

- Several large owner developers were on hand to deliver their thoughts on the vibrant Denver market.

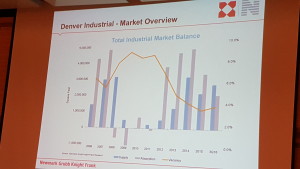

- The general consensus is that we are in a very good industrial market all along the Front Range.

- Just how long this will continue was debated, and although no one was willing to give a prediction, it looks like we are in the later stages of the cycle.

- Tax abatements, incentives, and public/private partnerships are driving construction, without them, it is almost impossible to get a deal to pencil.

- Any increase in interest rate or property tax will be a pass through and will affect tenants more than owners.

Call Tony Hemminger, John Jumonville or Matt Ritter for your commercial real estate needs. Western Investor Network will help you find a WINning Real Estate Solution. 720-344-1174